24/7 AI KYC Analyst. Makes client happy. Cost Less.

AgentKYZ deploys tireless AI agents that can do background research on internet without bothering clients with questions, checking docs, chasing missing info, delivers fast client onboarding, clear non-compliant cases quickly, and maintain good client relationship.

30-minute working session: map your workflow, see a live remediation, leave with an ROI plan.

53-78%

Faster onboarding cycles

82%

Fewer false positives

96%+

Document extraction accuracy

Estimates based on internal benchmarks and policy tuning.

Compliance cockpit

Orion Growth Fund

APAC + EMEA coverage

Document AI

ID + Source of Funds

Screening

False positives down 85%

Risk model

Jurisdiction + profile

Agent action

Requested missing beneficial owner ID and tax residency proof. Auto follow-up scheduled.

143

Cases

48h

SLA

12

In review

Executive outcomes

Great Client Experience. Stay Compliant. Efficient

AgentKYZ gives you automation with clear audit trail and governance that accelerates investor onboarding, and clear backlogs/non-compliant cases efficiently so no major delay that impact client relationships.

No delay in transaction processing

Non-compliant KYC cases can block or delay transactions. With AI reviewing, the risk is reduced.

Faster investor onboarding

Ingest, verify, and request missing data without manual chasing.

Align with PKYC framework from FATF

Using AI for more effective monitoring in alignment with the PKYC frameworks established by FATF

No more unnecessary questions that impact client experience

We do the necessary background research on the client so you don’t end up asking unnecessary questions and impact client experience. More time is saved reviewing work and ensure good quality.

Fund industry focus

Investor AML and client KYC, built for funds.

AgentKYZ is purpose-built for investor onboarding, refreshes, and remediation across the fund lifecycle—without breaking audit standards.

Investor onboarding

Ingest subscriptions, verify documents, and request missing information fast.

AML remediation

Clear refreshes and backlogs with explainable screening and risk checks.

Automate Perpetual KYC

Using Agentic AI to facilitate ongoing monitoring , for a more effective monitoring in alignment with the PKYC frameworks established by FATF.

Modular stack

Start with the pain. Expand without rewiring.

Deploy the modules you need now, then expand as adoption grows. Everything shares a unified orchestration and audit layer.

API ready

Modular by design

Plug into existing screening providers, document systems, and internal risk models. Control data residency, tool selection, and approvals.

Screening and watchlists

Cross-reference sanctions, PEP, and watchlists with context-aware filtering to cut false positives.

Risk assessment

Configure jurisdiction and investor-specific risk models that score and explain every decision.

Document AI

Extract and validate data from complex documents with OCR, rules, and AI verification.

Email and query hub

Auto-triage inboxes, pull attachments, draft responses, and route escalations.

Your Research Analyst

Our AI will do background research on clients with publicly available information, so saving you the need to ask unnecessary questions and bother clients.

Audit and reporting

Maintain immutable logs, explainability, and exportable audit trails for regulators.

Workflow

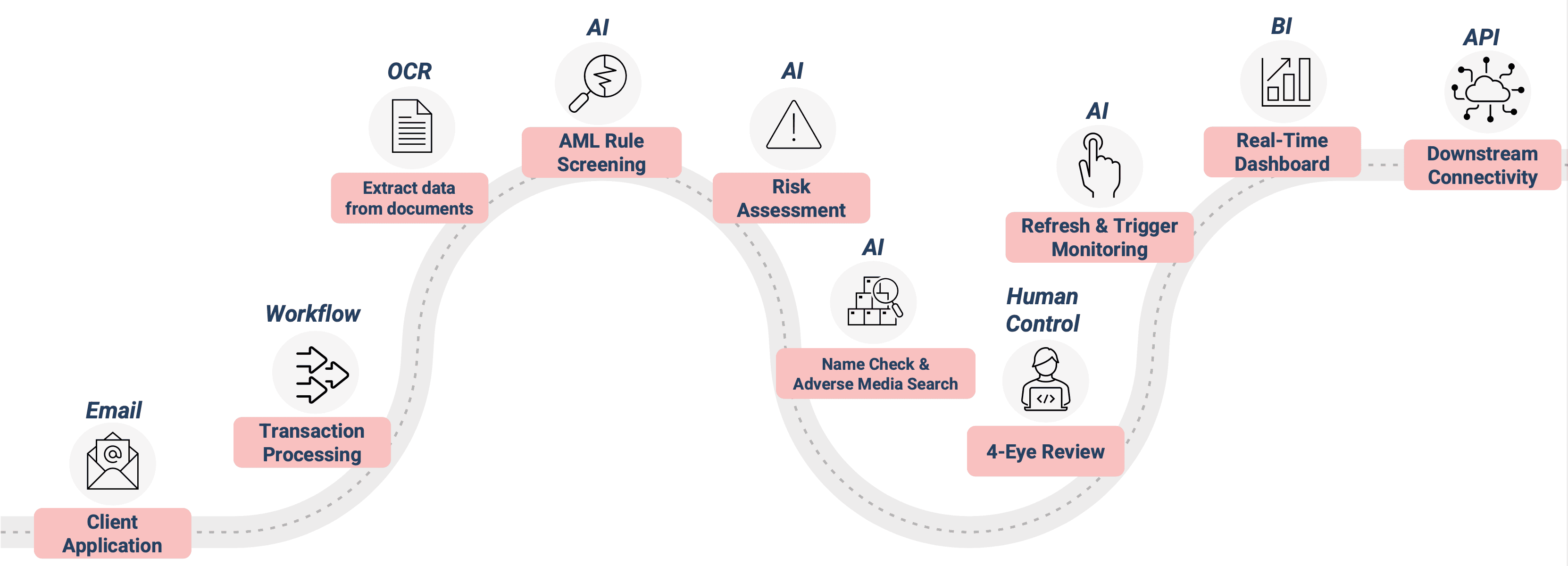

AI agents handle the routine. Your team handles judgment.

Agentic Process Automation keeps humans in control while AI handles intake, screening, risk, and documentation.

Ingest

Connect emails, portals, and APIs for intake.

Extract

Parse documents and normalize entity data.

Screen

Run sanctions, PEP, and watchlist checks.

Decide

Apply risk models, route approvals, explain results.

Complete

Close cases with audit-ready documentation.

Security and deployment

Built for regulated environments.

SOC 2 aligned controls, transparent audit trails, and configurable human-in-loop checkpoints keep decisions defensible.

- On-prem or cloud deployment with data residency control.

- Fine-grained approvals and policy-based automation rules.

- Full audit logs and explainability for every decision.

Governance baked in

AI agents make recommendations, while your team owns final approvals. Configure escalation paths, sampling strategies, and reviewer sign-offs to meet internal controls.